-

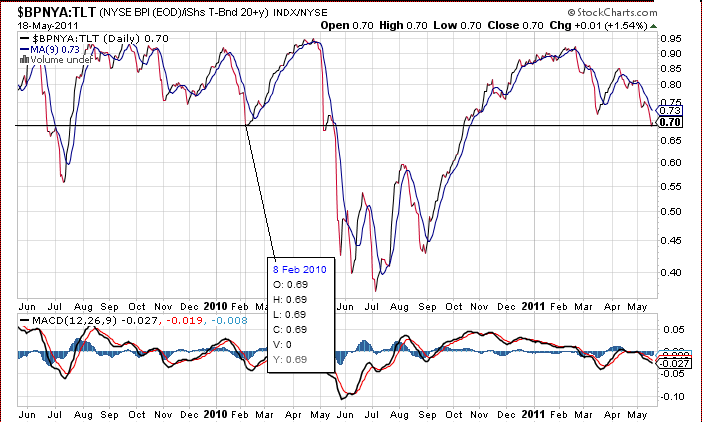

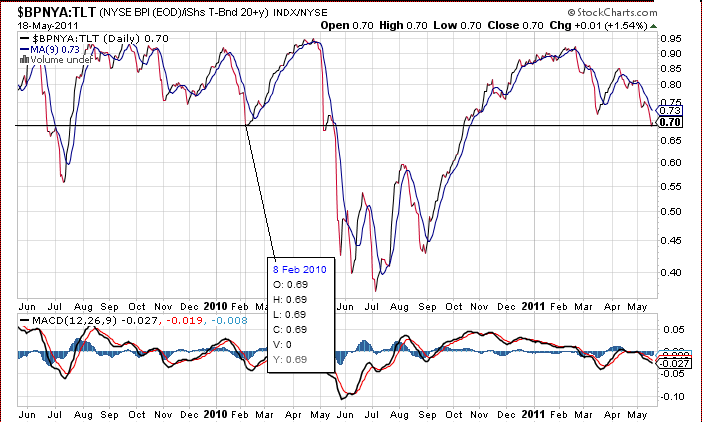

This ratio is only updated once a day, so it cannot be said to "tick." It would be more accurate to say that yesterday's 0.69 held to the basis point, and reversed up today to 0.70 (0.696 if un-rounded). Anything could happen next, but on the grounds of a full day bounce, I'm labeling 0.69 on this update as S2. The lowest POMO-active excursion to 0.56 will become S1 if validated, or not if violated.

The reversal also reflects and affirms Pascal's calls on both the USD and TLT of yesterday, with the TLT's > full point stair-step decline today (-1.28) the largest contribution to the ratio bounce. Three general paths from here could be characterized as 1) Strong continuation suggests POMO-inducement to risk has not reversed just yet; 2) weak continuation over multiple days involving a re-test of 0.69 would suggest a battle may be joined between FED bears and bulls (I think most likely of three); and 3) should this turn out to be a one-day zig, followed by a violation lower, then the next update will be upon any approach to 0.56 (which would make TZA holders very happy), or sustained rise above 0.69.

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

Forum Rules

Reply With Quote

Reply With Quote